Every cooperative housing society is legally required to prepare and submit its annual returns to the Registrar of Cooperative Societies. This obligation ensures financial transparency, regulatory compliance, and proper governance of the society.

As per the Maharashtra Cooperative Societies Act, 1960 and the Model Bye-laws, annual returns must be filed on or before 30th September every year.

Failure to comply can invite regulatory action, penalties, and compulsory audit by the Registrar.

Last Date for Filing Annual Returns

The final and mandatory deadline for submission of annual returns is 30 September following the close of the financial year.

For example, for the financial year ending 31 March, the returns must be filed by 30 September of the same year.

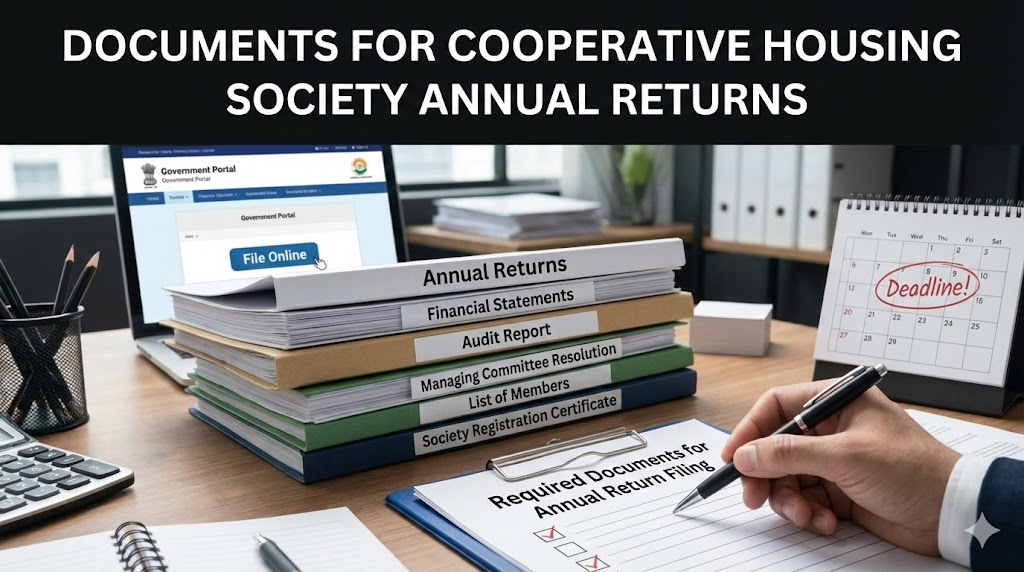

Documents Required to Be Filed with Annual Returns

While submitting annual returns, the society must file the following mandatory documents:

Annual Report of Society Activities

The society must submit a detailed report of activities carried out during the year. This includes administrative actions, major decisions, maintenance works, legal matters, disputes, and welfare initiatives approved by the general body.

Audited Statement of Accounts

The society must file audited financial statements, which include:

• Balance Sheet

• Income and Expenditure Account

• Receipts and Payments Account

• Auditor’s Report

The audit must be conducted by an auditor or auditing firm from the government-approved panel.

Plan for Disposal of Surplus

If the society has generated a surplus or profit, a plan for disposal of surplus must be submitted. This plan should be approved by the General Body and may include transfer to reserve funds or other permissible uses.

List of Amendments to Bye-laws

If the society has carried out any amendments to its bye-laws during the year, a detailed list of such amendments must be filed along with proof of approval.

Declaration Regarding AGM and Elections

The society must submit a declaration stating:

• the date on which the Annual General Body Meeting (AGM) was held, and

• whether elections were conducted, if due during the year.

This declaration is important to confirm democratic functioning and compliance with election norms.

Auditor Appointment Return (Within One Month of AGM)

In addition to the annual returns, every society must file a separate return regarding appointment of the auditor, which includes:

• name of the auditor or auditing firm from the approved panel,

• proof of appointment at the AGM, and

• written consent of the auditor.

This return must be filed within one month from the date of the AGM.

Consequences of Non-Filing of Annual Returns

If a society fails to submit annual returns within the prescribed time, the Registrar has the authority to:

• appoint an auditor from the approved panel,

• cause the society’s accounts to be audited compulsorily, and

• initiate action under the MCS Act and Bye-laws.

Members of the managing committee may also be held responsible for non-compliance.

This procedure is specifically covered under Bye-law 146.

Conclusion

Timely filing of annual returns is not a mere formality but a statutory obligation. Proper documentation, audited accounts, and accurate disclosures protect the society from legal complications and ensure smooth administration. Managing committees should plan audits and AGMs well in advance to meet the 30 September deadline without default.